Part 1 — Buying USDT on Luno

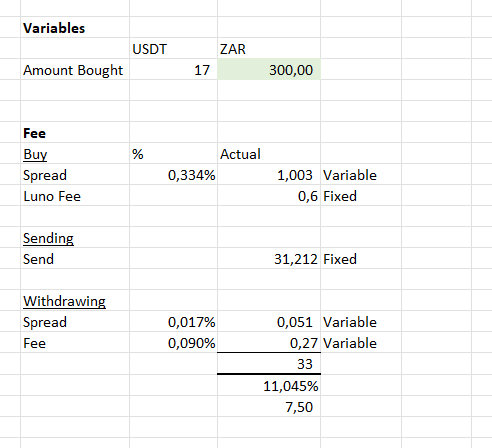

Luno was the obvious on-ramp: local compliance, direct ZAR deposits, and a Python SDK. I bought USDT at R17.398 while the interbank rate sat at R17.34, which means I paid 0.334% in slippage immediately. Luno also charged a fixed R0.60 fee. On the pilot ticket of R300, that translated to R1.60 just to own the stablecoin.

The upside is that the funds were available near instantly once the ZAR hit Luno, which already beats waiting for a SWIFT confirmation before initiating the next hop.

Notebook SnippetClick to expand

Code

from luno_python.client import Client

import os

from dotenv import load_dotenv

import yfinance as yf

c = Client(api_key_id=os.getenv('LUNO_API_KEY'), api_key_secret=os.getenv('LUNO_API_SECRET'))

ticker = "USDZAR=X"

data = yf.Ticker(ticker)

ask_price = data.info.get("ask")

pair = 'USDTZAR'

type = 'BUY'

counter_volume = 300

order_id = c.post_market_order(pair=pair, type=type, counter_volume=counter_volume)['order_id']

print('Successfully completed trade')

print('Order ID: ', order_id)

order_info = c.get_order(id = order_id)

token_bought = order_info['pair']

token_volume = float(order_info['trades'][0]['volume'])

price = float(order_info['trades'][0]['price'])

luno_fee = float(order_info['fee_base'] )* ask_price

total_cost = luno_fee + price * token_volume

print('Trade Details')

print('Order ID: ', order_id)

print('Volume Bought: ', token_volume)

print('Price: ', price)

print ('Total Cost (excl. fee): ', (token_volume * price))

print('Luno Fee: ', luno_fee)

print('Total Cost: ', total_cost)

spread_paid = (price - ask_price) * token_volume

print('\nSplippage Analysis')

print(f"Current ask price for USD/ZAR: {ask_price}")

print('Spread %: ', (price - ask_price) / ask_price * 100)

print('Spread Paid: ', spread_paid)

print('Luno Fee Paid: ', luno_fee)

print('Total Slippage: ', spread_paid + luno_fee)Output

Successfully completed trade Order ID: BXECWEAY5P2BBZZ Trade Details Order ID: BXECWEAY5P2BBZZ Volume Bought: 17.24 Price: 17.398 Total Cost (excl. fee): 299.94151999999997 Luno Fee: 0.597334968 Total Cost: 300.53885496799995 Splippage Analysis Current ask price for USD/ZAR: 17.3241 Spread %: 0.42657338620764307 Spread Paid: 1.2740359999999706 Luno Fee Paid: 0.597334968 Total Slippage: 1.8713709679999706

Part 2 — Sending USDT to Revolut X

Revolut’s exchange product accepts crypto deposits, so the next move was an on-chain transfer from Luno to Revolut X. Gas fees on the ERC-20 rail came to roughly 1.8 USDT (≈R30). The cruel part is that gas is flat—sending R300 or R3 000 000 would have cost almost the same, so small transfers get hammered.

Transfer ScriptClick to expand

Code

revolut_address = '0x0C8B8D01BFDa8c2D8c809B98A8aF5ABbCBDbc36f'

kraken_address = '0x65Fe33C8A60519D9d3C4Ab2498291196f7C95d28'

token = 'USDT'

send_fee = float(c.send_fee(amount = token_volume, currency = token, address=revolut_address)['fee'])

print('Estimated sending fee: USDT ', send_fee)

print('Rand Version', send_fee * ask_price)

amount_to_send = 10

print(amount_to_send)

c.send(amount = amount_to_send, currency = token, address=revolut_address)

print('Money Successfully Sent to Revolut')

print('\nUpdated Slippage Analysis')

print('ZAR to USDT Luno Fee: ', luno_fee)

print('Current ZAR/USD Spread Fee: ', spread_paid)

print('Send Fee: ', send_fee)

print('Total Slippage: ', spread_paid + luno_fee + send_fee)Output

Estimated sending fee: USDT 1.806868 Rand Version 31.302361918800003 10 Money Successfully Sent to Revolut Updated Slippage Analysis ZAR to USDT Luno Fee: 0.03448 Current ZAR/USD Spread Fee: -0.925787999999986 Send Fee: 1.814046 Total Slippage: 0.922738000000014

Part 3 — Cashing Out on Revolut

Once the tokens cleared, I sold USDT for GBP inside Revolut X and pushed the pounds into my Revolut current account. Revolut’s spread was 0.017% with a R0.27 fee, so this hop cost only R0.32. Within a few minutes, the pounds were spendable on my debit card.

Overall Breakdown

Overall it cost me ~ R33 transfer R300 from SA to the UK. That is roughly 11% on my transfer amount. Hahahaa, epic fail I guess.

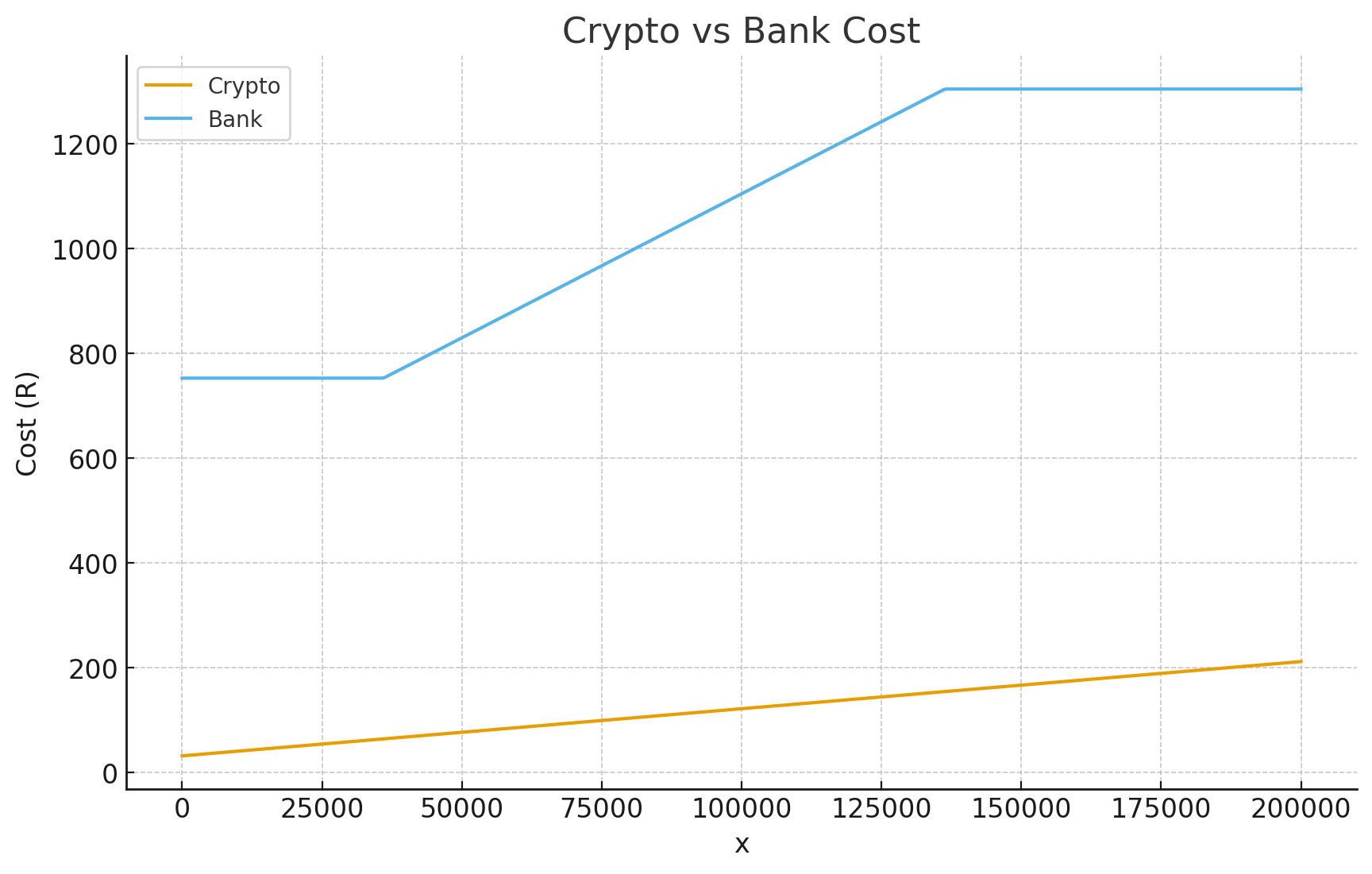

Well, lets look at how banks work and what fees they charge. Banks will also have a spread and then a fee component. I was unable to obtain a quote from the bank at the time of the project, however I am in doubt that it would be any lower than the 0.351% (0.334 + 0.017) charged by crypto.

Lets work of the assumptions however that the banks spread would be equivalent to the crypto spread. This leaves us only comparing the fees.

On the crypto side the fees amount to 31.81 (0.6 + 0.31) + 0.09%. On the banks side (specifcally quoting Nedbank) it is 0.55% (min R198, max R750) + R555.

Traditional Bank Fees (Reference)

- Nedbank service fee: R555

- Nedbank commission: 0.55% (min R198, max R750)

- Implied spread (assumed): ≈0.334%

Takeaways

- Gas costs are the main drag for small-value transfers but amortize nicely on larger tickets.

- Bank fees are still far higher in absolute terms, especially when minimum service charges kick in.

- Crypto is a far better alternative in most personal transfer scenarios—if you can stomach the UX.

Conclusion

The project ultimately worked, but it also confirmed I've burned far too much cash on needless bank fees when sending money overseas. I'm still not entirely sure how compliance and legality shake out for crypto rails at scale, so I'd love to hear from people who have navigated that side—or anyone with even more efficient cross-border workflows.

Disclaimer: Everything here is strictly for educational purposes. Please don't recreate it without proper legal and compliance guidance for your own situation.