Stablecoins in Plain English

I guess before I dive straight into the project, it would be important to disuses what stable coins are.

Let’s start with regular crypto. I like to think of cryptocurrencies simply as another form of money. Not an investment vehicle, but a type of digital currency, just like a rand or a dollar. One of the big differentiating factors is crypto's decentralised nature, however that concept is better explained here.

However, the challenge with using most cryptocurrencies as everyday money is their extreme price volatility. If I wanted to buy a cup of coffee using Bitcoin, the price of Bitcoin might swing up or down by 20% within hours. That means I could end up paying significantly more or less for the same coffee depending on the exact time of day I make the purchase.

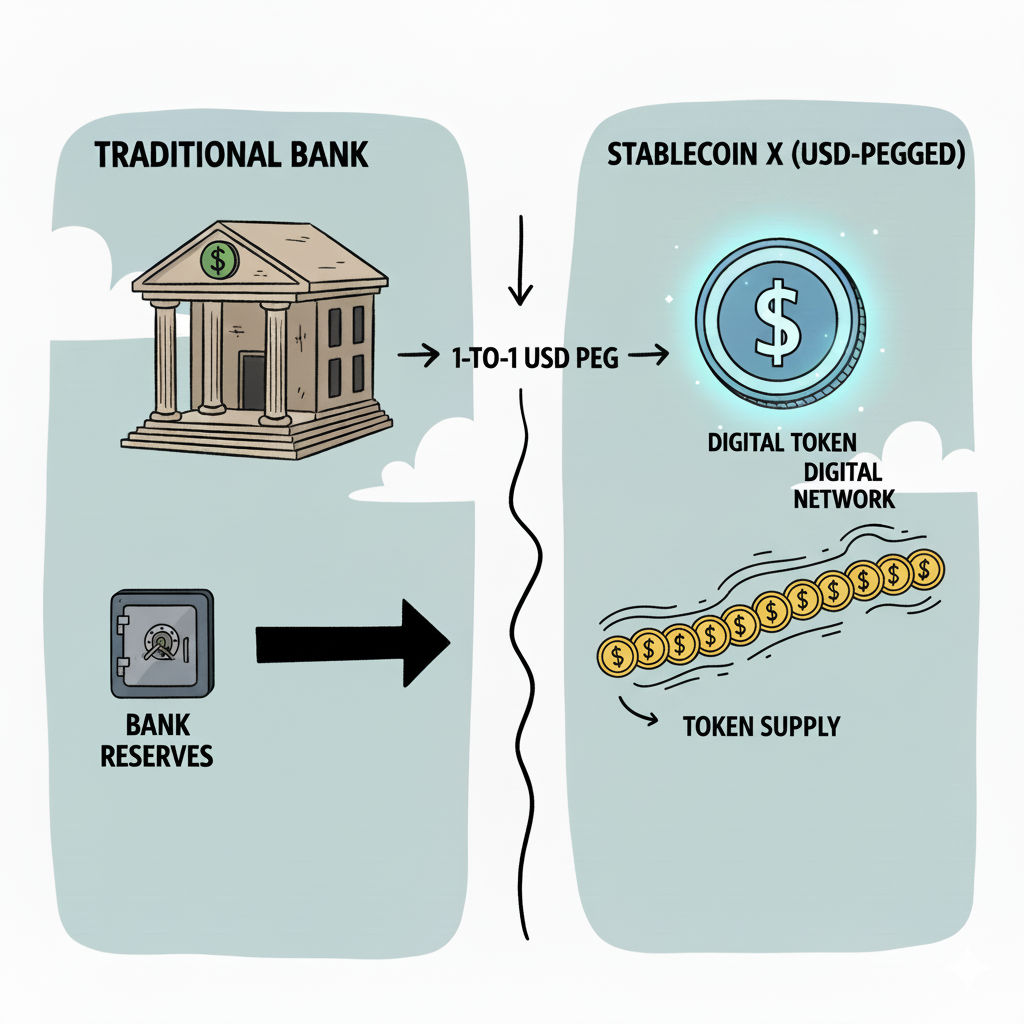

This is where stablecoins come in. A stablecoin is a type of cryptocurrency whose value is pegged to something stable, usually a traditional currency. The idea is simple: for every 1 stablecoin that exists, the issuer holds 1 unit of real currency (like 1 rand or 1 dollar) in reserve. This backing helps keep the price steady.

Why is this useful? Because a stablecoin gives you the stability of traditional money while offering the flexibility of a digital asset. You can transfer it instantly, use it anywhere, avoid many of the usual banking delays, and often pay minimal fees. In short, it’s traditional currency upgraded for the digital world.

Why I Picked USDT

Not all stablecoins are created equal. USDT was the only token that ticked every requirement for this experiment: available on South African and UK rails, battle-tested liquidity, and friendly APIs for automation.

- Highest liquidity worldwide, which keeps spreads tight.

- Supported by both Luno (South Africa) and Revolut X (UK).

- Python-friendly APIs, making automation painless.

- Mature tooling for transfers, explorers, and compliance monitoring.

Myths I Had to Unlearn

Stablecoins are still wrapped in misconceptions. These were the blockers I had to dismantle before trusting them with real money.

Myth

“Crypto is too volatile to buy coffee with.”

Reality

Stablecoins are pegged 1:1 to fiat currencies, so the purchasing power holds steady while still living on programmable rails.

Myth

“Stablecoins are unregulated grey-market tokens.”

Reality

Major issuers publish reserve attestations and partner with licensed exchanges. This project deliberately used mainstream platforms (Luno, Revolut X).

Myth

“It’s only for whales or advanced traders.”

Reality

Consumer banks are rolling out crypto facilities. If you can navigate online banking, you can move stablecoins.